Published by: Sujan

Published date: 14 Jun 2021

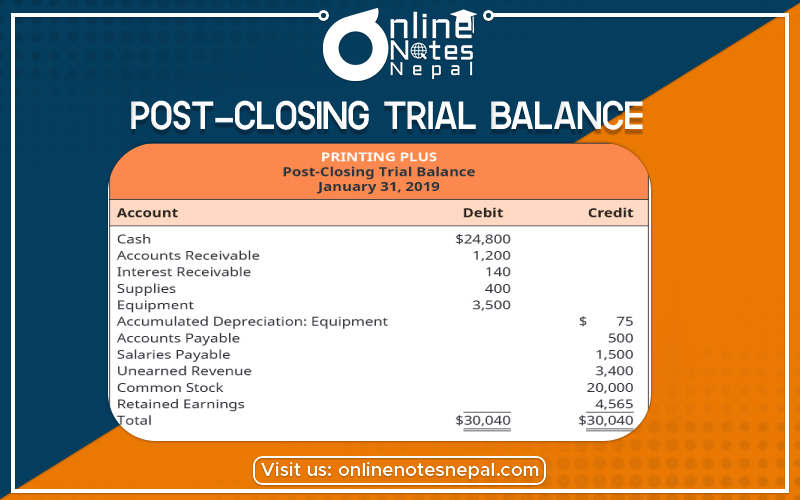

The last step in the accounting cycle is to prepare a post-closing trial balance. A post-closing trial balance is prepared after closing entries are made and posted to the ledger. It is the third (and last) trial balance prepared in the accounting cycle. The post-closing trial balance (also known as the after-closing trial balance) is the last step of the accounting cycle and is prepared after making and posting all necessary closing entries to relevant ledger accounts. Since closing entries close all temporary ledger accounts, the post-closing trial balance consists of only permanent ledger accounts (i.e, balance sheet accounts). The purpose of preparing a post-closing trial balance is to assure that accounts are in balance and ready for recording transactions in the next accounting period.

For a recap, we have three types of trial balance. They all have the same purpose (i.e. to test the equality between debits and credits) although they are prepared at different stages in the accounting cycle.

This is prepared after journalizing transactions and posting them to the ledger. Its purpose is to test the equality between debits and credits after the recording phase.

This is prepared after adjusting entries are made and posted. Its purpose is to test the equality between debits and credits after adjusting entries are prepared. It is also the basis for preparing financial statements.

An adjusted trial balance contains nominal and real accounts. Nominal accounts are those that are found in the income statement and withdrawals. Real accounts are those found in the balance sheet.

This is prepared after closing entries are made. Its purpose is to test the equality between debits and credits after closing entries are prepared and posted. The post-closing trial balance contains real accounts only since all nominal accounts have already been closed at this stage.