Published by: BhumiRaj Timalsina

Published date: 20 Jan 2022

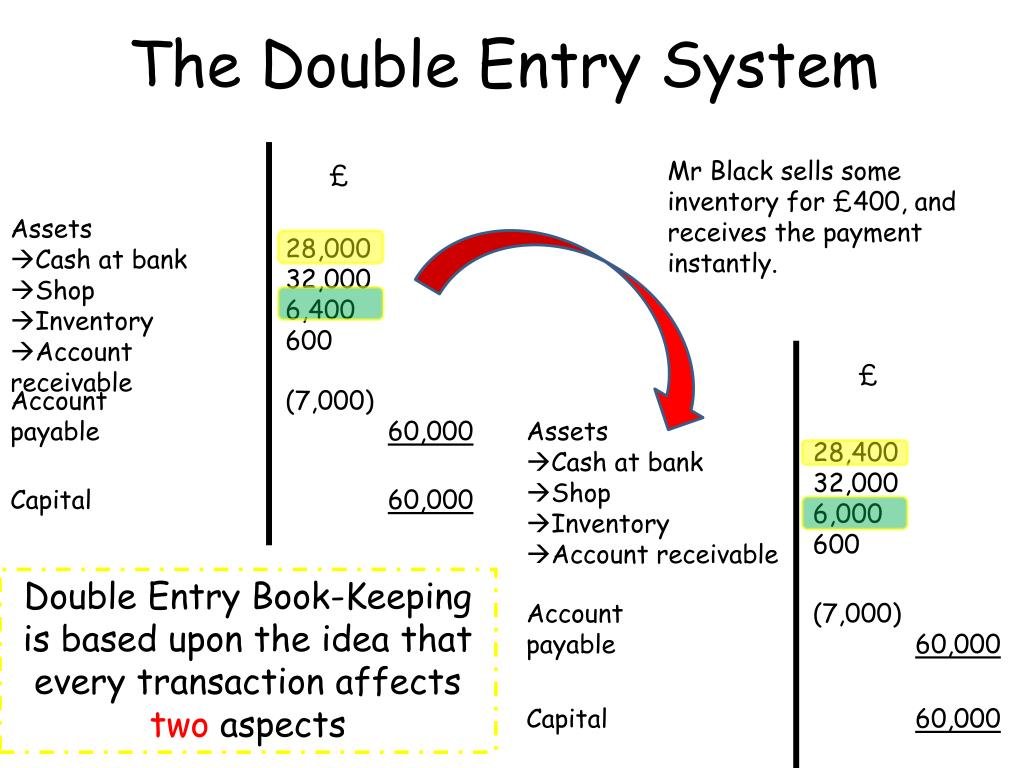

Book-keeping is an act of keeping permanent records of financial transactions of a business in a systematic way. It helps to determine true profit or loss and financial position of a business. Modern organization maintains the record of financial transactions under double entry system. Double Entry system is referred to such accounting system under which every financial transaction is recorded into two separate accounts with an equal amount to determine the true profit or loss and financial position of the business.Double entry system emphasizes that every financial transaction has two aspects. Each transaction is recorded in two separate accounts with an equal amount. It records both aspects of transactions into debit and credit. The profit and loss account and balance sheet are prepared to know the profitability and financial position of the business. Thus, double entry system is more systematic, scientific and complete system of book-keeping. The following are the definitions of double entry system of book-keeping:

"The specific technique which reflects the concept of duality is known as double entry book- keeping." -Lewis and Gillespie

"Double entry system is the system under which each transaction is regarded to have two fold aspects and both the aspects are recorded to obtain a complete record of dealings." -Juneja, Chawla, and Saksena

The following are the main features of double entry system of book keeping:

Differences between Single and Double Entry System

| S.N | Single Entry System | Double Entry System |

| 1 | It is not based on the concept of duality. | It is based on the concept of duality. |

| 2 | It maintain the cash book and personal account of debtors and creditors. | It maintains personal, real and nominal accounts. |

| 3 | It does not maintain nominal account so it cannot help to ascertain true profit or loss of the business. | It can help to ascertain true profit or loss of the business. |

| 4 | It cannot help to prepare a trial balance. | It can help to prepare a trial balance. |

| 5 | It is suitable for small businesses. | It is suitable for large businesses. |

| 6 | It is not acceptable for tax purpose. | It is acceptable for tax purpose. |