Published by: sadikshya

Published date: 06 Jul 2021

This theory develops by classical economist Marshall, A.C. Pigou, Wales, Taussig, etc. according to the classical theory of interest, the rate of interest is determined by the interaction between demand and supply of capital. In other words rate of interest is determined at that point where demand and supply of capital are equal. The theory is also known as demand and supply of capital, the theory of interest saving investment interval real theory of interest.

The demand for capital arises from the desire of investment because a firm wants to purchase new capital goods; capital goods are demanded because they can be used to produce consumer goods. Thus the productivity of capital depends upon the marginal efficiency of capital there is an inverse relationship between investment and productivity of capital. If the rate of interest is a higher demand for capital is low and vice versa. So the demand curve slopes downward from left to right.

The supply of capital results from savings, saving is highly influenced by the rate of interest. Higher the rate of interest, the higher will be saving and vice versa. Thus there is a positive relationship between the supply of capital and rate of interest.

Determination of the rate of interest

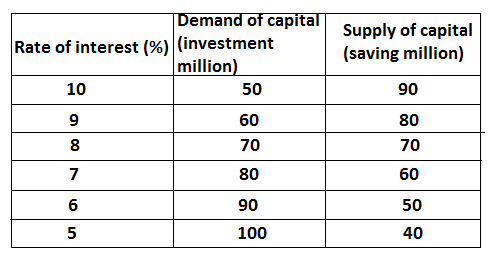

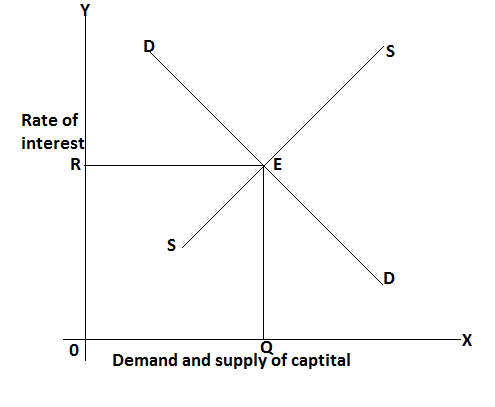

Rate of interest is determined at the point where demand and supply of capital are equal, in other words, equilibrium saving and investment determined rate of interest. This can be shown with the help of the following table and diagram.

The table and diagram show that the rate of interest is determined by the equality between demand and supply of capital at a percentage rate of interest demand and supply of capital are equal,70 million Rs 50 this is an equilibrium rate of interest. In the diagram, E point is an equilibrium point where demand-supply is equal.