Published by: Dikshya

Published date: 05 Jul 2023

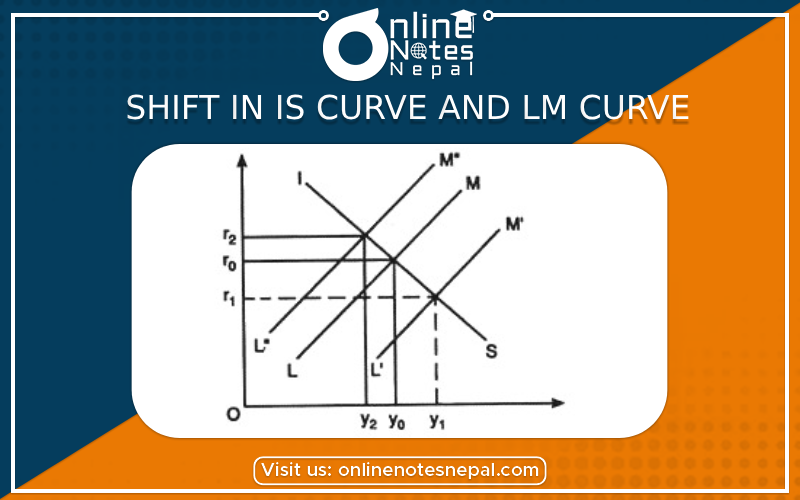

A shift in the IS and LM functions occurs when there are changes in the factors that determine the equilibrium in the product and money markets. Let's examine how shifts in different variables affect the IS and LM functions:

Fiscal Policy: Changes in government spending (G) or taxes (T) directly impact the IS function. An increase in government spending or a decrease in taxes will shift the IS curve to the right, indicating higher levels of output for a given interest rate. Conversely, a decrease in government spending or an increase in taxes will shift the IS curve to the left, reflecting lower levels of output for a given interest rate.

Investment: Changes in autonomous investment (I) will also shift the IS curve. An increase in autonomous investment will shift the IS curve to the right, indicating higher output for a given interest rate. Conversely, a decrease in autonomous investment will shift the IS curve to the left, reflecting lower output for a given interest rate.

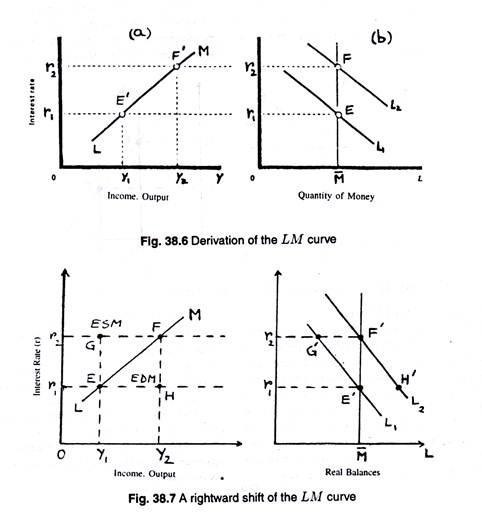

Shifts in the LM Function:

Money Supply: Changes in the money supply (M) directly impact the LM function. An increase in the money supply will shift the LM curve to the right, indicating lower interest rates for a given level of output. Conversely, a decrease in the money supply will shift the LM curve to the left, reflecting higher interest rates for a given level of output.

Money Demand: Changes in the factors affecting money demand, such as shifts in income (Y) or changes in preferences for holding money, will also shift the LM curve. An increase in income or an increase in the demand for money will shift the LM curve to the right, indicating higher interest rates for a given level of output. Conversely, a decrease in income or a decrease in the demand for money will shift the LM curve to the left, reflecting lower interest rates for a given level of output.

It's important to note that shifts in the IS and LM functions interact with each other, as changes in one curve can influence the other. The intersection of the shifted IS and LM curves determines the new equilibrium level of output and interest rate in the economy.

A simultaneous shift in the IS and LM functions occurs when there are changes in factors that affect both the product market (IS function) and the money market (LM function) at the same time. Let's consider some scenarios:

Expansionary Fiscal Policy and Increase in Money Supply: If there is an expansionary fiscal policy, such as an increase in government spending (G) or a decrease in taxes (T), this will shift the IS curve to the right, leading to higher output for a given interest rate. At the same time, if there is an increase in the money supply (M), this will shift the LM curve to the right, resulting in lower interest rates for a given level of output. The simultaneous shift in the IS and LM functions would lead to an increase in both output and a decrease in interest rates.

Contractionary Fiscal Policy and Decrease in Money Supply: If there is a contractionary fiscal policy, such as a decrease in government spending or an increase in taxes, this will shift the IS curve to the left, leading to lower output for a given interest rate. At the same time, if there is a decrease in the money supply, this will shift the LM curve to the left, resulting in higher interest rates for a given level of output. The simultaneous shift in the IS and LM functions would lead to a decrease in both output and an increase in interest rates.

Shifts in Investment and Money Demand: Changes in autonomous investment (I) and factors affecting money demand can also lead to simultaneous shifts in the IS and LM functions. For example, if there is an increase in autonomous investment and an increase in money demand (e.g., due to an increase in income), the IS curve would shift to the right, indicating higher output, while the LM curve would shift to the right, indicating higher interest rates. The net effect on output and interest rates would depend on the magnitude of the shifts in each curve.

Simultaneous shifts in the IS and LM functions reflect the interaction between fiscal policy, monetary policy, and other factors affecting the economy. The resulting equilibrium level of output and interest rate will depend on the combined effect of these shifts.