Published by: sadikshya

Published date: 18 Jun 2021

The principle of effective demand Repudiation of Say’s Law and Full Employment Theory is that supply and creates its own demand and that full employment equilibrium is a normal situation in the economy. This principle points out that underemployment equilibrium is a normal situation and full employment equilibrium is accidental. In a capitalist economy, supply fails to create its own demand because the whole of the earned income is not spent on the consumption of goods and services. Moreover, the decisions to save and invest are made by different people. As a result, the existence of full employment is not a possibility and the point of effective demand at any time represents unemployment equilibrium.

The Pigouvian view that full employment can be achieved by a reduction in money wage-cut is also repudiated by this principle. A money wage-cut also repudiated by this principle. A money wage-cut will bring about a reduction in expenditure on goods and services leading to a fall in effective demand and hence in the level of employment. Thus the importance of this principle lies in repudiating Say’s Law and the classical thesis of full employment equilibrium.

Repudiation of Say’s Law and Full Employment Theory are described below:-

1. Self-Adjustment not Possible

Keynes did not agree with the classical view that the laissez-faire policy was essential for an automatic and self-adjusting process of full employment equilibrium. He pointed out that the capitalist system was not automatic and self-adjustment for the reason that the non-egalitarian structure of its society. There are two principal classes, the rich and the poor. The rich possess much wealth but they do not spend the whole of it on consumption. The poor lack money to purchase consumption goods.

2. Equality of Saving and Investment through Income Changes

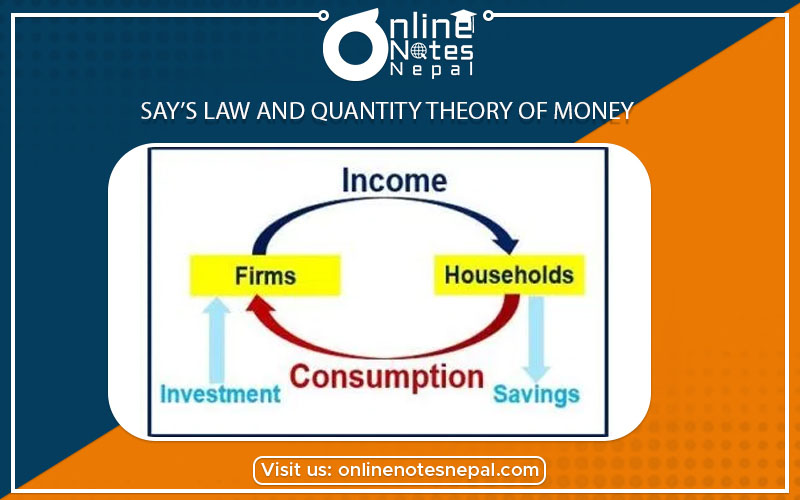

The classicists believed that saving and investment were equal at the full employment level and in case of any divergence; equality was brought about by the mechanism of the rate of interest. Keynes held that the level of saving depended upon the level of income and not on the rate of interest. Likewise, investment is determined not only by the rate of interest but by the marginal efficiency of capital.

3. Importance of Speculative Demand for Money

The classical economists believed that money was demanded transactions and precautionary purposes. They did not recognize the speculative demand for money for the reason that money held for speculative purposes related to idle balances. But Keynes did not agree with this view. He emphasized the importance of speculative demand for money.

4. Rejection of Quantity Theory of Money

Keynes rejected the Classical Quantity Theory of Money on the ground that the increase in money supply will not necessarily lead to rising prices. It is not essential that people may spend all the extra money. They may deposit it in the bank or save. So the velocity of circulation of money (V) may slow down and not remain constant.

5. Money not Neutral

The classical economists regarded money as neutral. Therefore they exclude the theory of productivity, employment, and interest rate from monetary theory. According to them, the level of productivity and employment and the equilibrium rate of interest were determined by real forces. Keynes criticized the classical view that monetary theory was separate from value theory. He integrated monetary theory with value theory and brought the theory of interest in the domain of monetary theory by regarding the interest rate as a monetary phenomenon.

6. Refutation of Wage-Cut

Keynes refused the Pigovian formulation that a cut in money wage could achieve full employment in the economy. The greatest fallacy in Pigou’s analysis was that he extended the argument to the economy which was applicable to a particular industry.