Published by: Dikshya

Published date: 07 Jul 2023

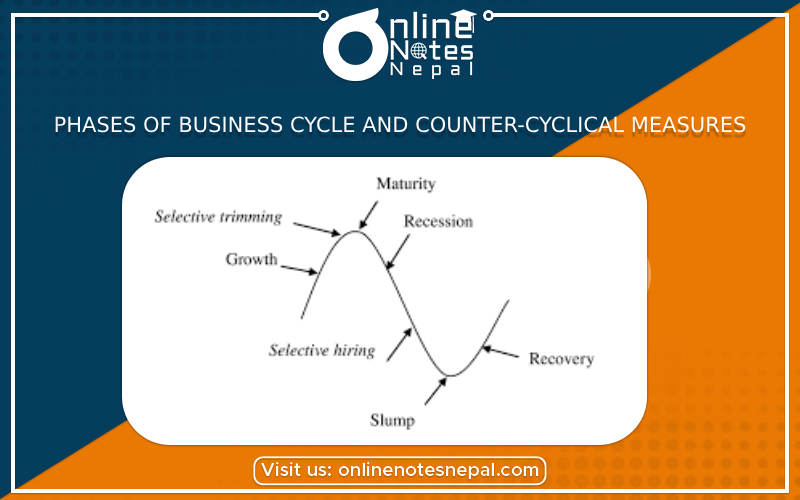

1. Expansion/ Boom:

This phase is marked by an increase in economic activity, such as rising production, employment, and consumer spending. Businesses experience growth, and there is an overall positive sentiment in the economy. During this phase, GDP tends to rise , and unemployment rates tend to fall. It is a period of prosperity and economic growth.

2. Peak :

The peak represents the highest point in business cycle, where economic activity reaches its maximum level. It signifies the end of the expansion phase and is characterized by high levels of production, employment, and consumer spending. However, at the peak, the economy is operating at or near its full capacity, and inflaationary pessures may start to build.

3. Contraction / Recession:

After reaching the peak, the economy enters a contraction phase. During this phase, economic activity declines, and there is a decrease in production, employment and consumer spending. GDP groeth slows down, and unemployment rates tend to rise. The recession phase is generally characterized by reduced business profits, declining investment and pessimistic sentiment in the economy.

4. Trough :

The trough represents the lowest point of the business cycle, where economic activity reaches its minimum level. It signifies the end of the contraction phase and the beginning of the recovery. During this phase, the economy starts to stabalize, and there are signs of improvement in production, employment, and consumer spending. The trough is the starting point for the next expansion phase.

Counter- cyclical measures:

Counter-cyclical measures, also known as countercyclical policies, are economic policies implemented by governments and central banks to offset the effects of business cycles and stabalize the economy. These measures are designed to reduce the amplitude of economic fluctuations and promote long-term economic stability. Some counter-cyclical measures are:

1. Monetary Policy:

The measures aim to stimulate borrowing and spending, promoting investment and economic growth. During periods of high inflation and economic expansion, central banks may pursue contractionary monetaru policy by raising interest rates and tightening credit conditions to curb excessive borrowing and control inflation.

2. Fiscal Policy:

Durinf this periods of strong economic growth and potential overheating, contradictory fiscal policy may be employed. This can include reducing government spending, increasing taxes, and implementing measures to reduce budget deficits and control inflation.

3. Exchange Rate Policies:

Governments can use exchange rate policies as counter-cyclical measures, particularly in open economies. During peiods of economic weakness, authorities may choose to devaluate the currency to boost exports and make domestic goods more competitive in international markets. This can stimulate economic activity and help to alleviate the effects of a recession.

Counter-cyclical measures aim to smooth out the peaks and troughs of the business s=cycles, minimizing the negative impacts of economic downturns and prompting sustainable growth. The effectiveness of these measures depends on various factors, including the state of the economy, the timeliness of policy implementation, abd the coordination between monetary and fiscal authorities.