Published by: sadikshya

Published date: 18 Jun 2021

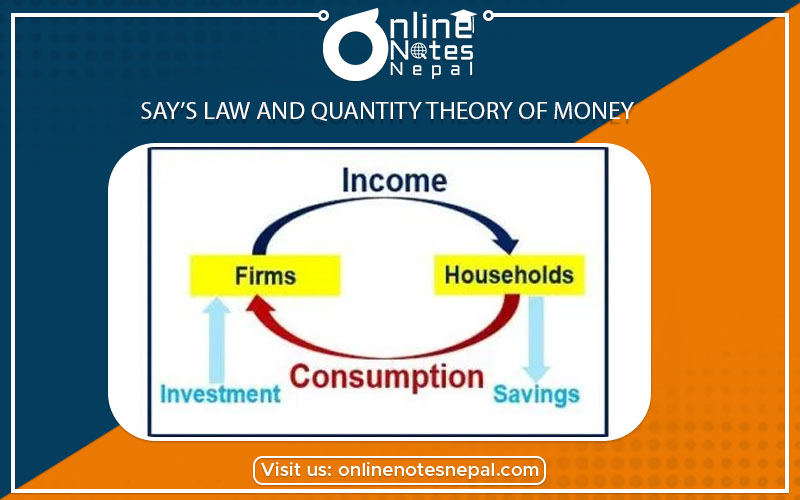

Say’s law and quantity theory of money Market lies at the center of the classical notion of full employment. J.B. Say, a French economist of the 19th century, introduced a theory of markets, according to which “supply creates its own demand.”

Say’s law simply holds well that supply creates its own demand, because goods will be produced either for self-consumption or for the direct exchange to get something else. According to say’s the main source of demand is the flow of factor incomes generated from the process of production itself. Thus, according to Say’s law, additional output creates additional incomes, which creates an equal amount of extra expenditure.

The main assumptions of Say’s law of market are listed below:

1) Free enterprises economy

2) No government intervention.

3) The validity of long-run,

4) Optimum allocation of resources,

5) The extent of the market is limitless.

6) A closed economy, no trade links with any other country,

7) Money is only a medium of exchange.

8) Automatic adjustment of the economic system due to the flexibility of wages, interest, and prices.

These are some main assumptions of Say’s law of the market and money.

Say’s the law has the following implications:

1) Policy Implications

2) Equality between Saving and Investment

3) Money has only a passive role.

4) Automatic Adjustment

5) Use of employed resources pay itself

6) Possibility of unlimited output and growth of capital

7) Say’s own observations

8) General overproduction is impossible

9) General employment is impossible

10) Partial overproduction and Partial unemployment are possible

These are some of the implications of say’s law and the theory of money.