Published by: Dikshya

Published date: 05 Jul 2023

To derive the IS curve, we start with the national income identify, which states that total output (Y) is equal to consumption (C), investment (I), and government spending (G), minus net exports.

Y= C+I+G-NX

Next, we assume a simple consumption function where consumption (C) is a function of disposable income (Y - T), where T represents taxes:

C=C(Y-T)

Substituting this consumption function into the national income identity, we have:

Y=C(Y-T) +I+G-NX

Rearranging the equation, we get:

Y - C(Y - T) = I + G - NX

Simplifying further:

Y - C(Y - T) = I + (G - NX)

Now, we assume that investment (I) and net exports (NX) are exogenous, meaning they are determined outside the model. Let's represent exogenous investment as Ibar and net exports as NXbar:

I + (G - NX) = Ibar + (G - NXbar)

Substituting this into the equation above:

Y - C(Y - T) = Ibar + (G - NXbar)

Expanding the equation:

Y - C(Y - T) = Ibar + G - NXbar

Distributing the negative sign in the consumption function:

Y - CY + CT = Ibar + G - NXbar

Factoring out Y on the left-hand side:

Y(1 - C) = Ibar + G - NXbar + CT

Dividing both sides by (1 - C):

Y = (Ibar + G - NXbar) / (1 - C) + (CT / (1 - C))

Let's define autonomous spending (A) as (Ibar + G - NXbar) / (1 - C), and the marginal propensity to consume (MPC) as the change in consumption for a given change in disposable income:

MPC = ΔC / Δ(Y - T)

We can rewrite the equation as:

Y = A + MPC(Y - T)

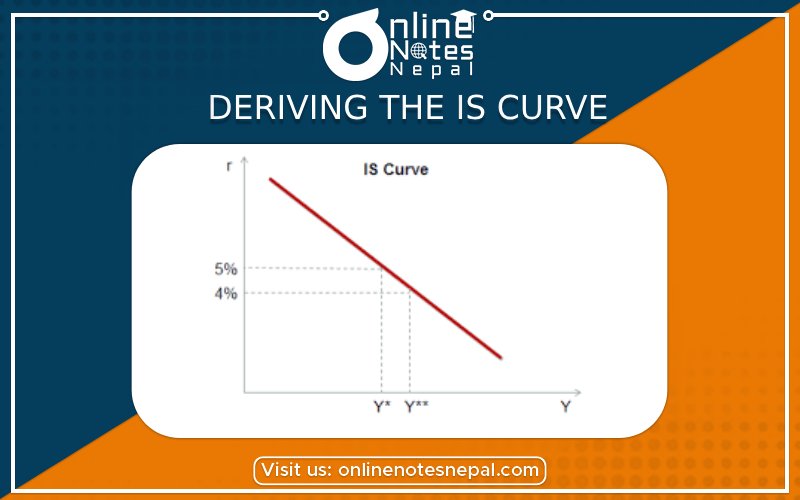

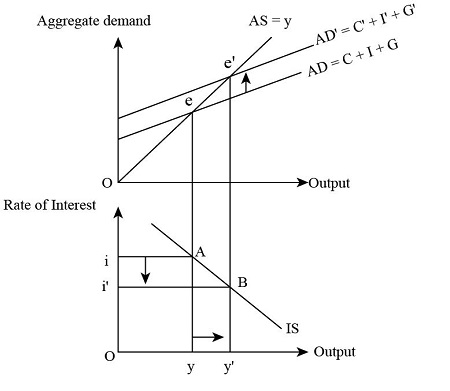

This equation represents the IS curve. It shows the relationship between output (Y) and the interest rate (r) that ensures equilibrium in the product market. The IS curve slopes downward because as the interest rate decreases, investment increases, leading to higher output. Changes in autonomous spending (A), taxes (T), or the MPC can shift the IS curve.