Published by: Anu Poudeli

Published date: 21 Jul 2023

Option markets are an important aspect of the financial ecosystem because they provide investors with vital tools for risk management, speculating on price changes, and improving their investing strategies. Let's look at the structure of option markets to see how they work and what the major components are.

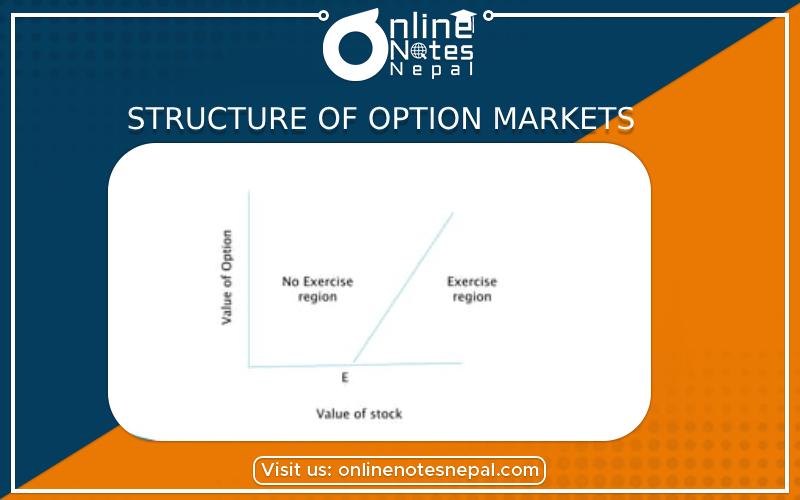

Options are financial derivatives that give the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset (such as stocks, commodities, currencies, or indexes) at a predetermined price (strike price) on or before a specific date (expiration date) at a predetermined price (strike price). They are frequently used to hedge against adverse price swings, speculate on future price movements, and create money through trading tactics.

Option Categories:

There are two kinds of choices:

Participants in the Option Market:

The option market has several participants, including:

Option Exchanges:

In the United States, option contracts are often traded on specialized exchanges such as the Chicago Board Options Exchange (CBOE). These exchanges serve as mediators, ensuring that transactions between buyers and sellers are smooth and transparent. They define contract specifications such as the underlying asset, contract size, strike prices, and expiration dates.

Contract Requirements:

Each option contract includes the following features:

Underlying Asset: The asset that determines the option's value, such as a specific stock or an index.

Underlying Asset: The asset that determines the option's value, such as a specific stock or an index.

The quantity of the underlying asset represented by a single options contract (contract size). In the United States, equity options are often sold in lots of 100 shares.

Strike Price: The predetermined price at which the underlying asset can be purchased or sold when the option is exercised.

The date on which the option contract expires if it is not exercised.

Option Pricing: The premium for an option is influenced by a number of factors, including the underlying asset's price, the strike price, the time to expiration, market volatility, and current interest rates. Option pricing methods, such as the Black-Scholes model, assist in estimating option prices.

Option Trading methods: Investors employ a variety of option trading methods to achieve a variety of goals, including:

Owning the underlying asset while selling call options against it to earn income is referred to as a covered call.

Buying put options to hedge against potential negative risk in an existing position is known as a protective put.

Straddle and strangle: Buying both call and put options at the same time to profit from large price fluctuations in either direction.

Butterfly Spread: A combination of call and put options that allows you to profit from limited price movement while limiting risk.

Finally, option markets provide investors with a variety of tools for risk management and speculation. Understanding the structure of option markets and the numerous techniques available enables investors to make more educated decisions and more effectively traverse the complexity of the financial world. However, options trading entails risks and complexities, and it is critical for individuals to adequately educate themselves or seek guidance from financial professionals before engaging in options trading activities.